Market Updates - March

We are very excited to present the very first official B&E newsletter, which will cover headlines that matter in the global markets.

(Feature Photo Source: CNBC)

This article is collectively written by Bruce Chen, Yao Yao, Amber Zang, and Zinan (Alex) Zhou.

Global Headlines

Russo-Ukrainian Crisis

At present, the Russian-Ukrainian war focuses primarily on the following three points:

Russia's "blitzkrieg" has suffered setbacks, and now it has entered a long stage of stalemate and negotiation. Russia is facing double consumption of materials and economy.

France and Germany have turned, and the confrontation between Russia and Europe has intensified. Due to political and military factors, the process of Russia's "Nord Stream-2" natural gas pipeline has stalled, resulting in periodic natural gas shortages in many parts of Europe, causing natural gas prices to rise. At the same time, the U.S. intervention in this regard may ease the country’s inflation problem in the long run.

Europe and the United States removed Russia from the SWIFT system. More than 40% of Russia's oil and gas export earnings will theoretically be cut off; the Russian currency may fluctuate greatly, and capital may flee. However, Europe and the United States have not entirely banned Russia. Because SWIFT is just a settlement system, a payment channel (similar to Alipay), the channel is forbidden but the transaction is not really forbidden. Russia cannot use SWIFT, it can find other ways to pay for transactions, but the procedure is more troublesome.

State of the Union

On March 1st, 2022, US President Joe Biden gave his 2022 State of the Union speech. Biden emphasized the economic growth and job creation in the US last year. However, he also highlighted the high inflation pressure of the US economy; People are facing higher prices for gasoline, goods as well as services. Therefore, in his speech, Biden proposed some policies to address high inflation. He unveiled his plan to invest in American manufacturing to fight inflation rather than reduce the wage, since the US needs to strengthen its supply chain by investing in manufacturing and then will lower prices as well as create new jobs. To lower the price of gasoline, Biden revealed that along with other major oil consumers, the US will release 60 million barrels of oil from emergency reserves. He also put forward proposals to solve industrial shortfalls, including revitalizing chip and other weak industries, and developing infrastructure projects. Biden’s speech indicated that the US economy is suffering from high inflation. Moreover, Biden’s approval rate dropped while giving the State of the Union, which implies that he could suffer further in the midterm elections.

Federal Reserve’s March Meeting

Jerome Powell, the Chair of the Federal Reserve, told Congress that the Fed is poised to raise interest rates in March to curb rampant inflation, with a potential target of a 25-basis-point hike in the Fed Funds Rate. Russo-Ukrainian war adds uncertainty to this decision and Jerome Powell expressed that the Fed will move “carefully”.

China Two Sessions 2022

The following is the summary of the economic agenda from the China Two Sessions.

Achievements of 2021

GDP exceeded 114 trillion yuan, an increase of 8.1%.

More than 12.69 million urban jobs were created, and the surveyed unemployment rate averaged 5.1%.

The consumer price index rose by 0.9%.

Goals for 2022

GDP increases by around 5.5%.

Over 11 million new urban jobs will be created, and the surveyed urban unemployment rate will be kept within 5.5 percent.

3.Keep the CPI increase at around 3 percent.

Emphasis

Tax cuts: Small-scale taxpayers will be exempted from VAT for a period of time.

Stabilize and expand consumption: 3.65 trillion yuan of special bonds for local governments will be issued this year.

Foreign trade: Implement a negative list for foreign investment, and ensure that foreign-invested enterprises receive national treatment.

Global Markets

US Markets

So far this year, the US stock market has lost around $7 trillion. The Standard & Poor 500 Index fell from approximately 4800 to just 4300, which was a retracement of nearly 10%. Besides that, the NASDAQ 100 Index has dropped 18% this year. The fall of the US stock market is possibly because of the war between Russia and Ukraine as well as the US economic sanction against Russia. Meanwhile, the inflation in the US economy also caused its fall. In addition, the US stock market has risen for a decade, and the valuation is high, which may also cause the fall of the stock market. For the future, since the situation between Russia and Ukraine isn’t clear, and the inflation can’t be solved in the short term, the US stock market may still fall in a short period. But for the long run, it is hard to tell how the economy will change.

World Markets

At the beginning of 2022, the global epidemic continued to rebound, and the risk of geopolitical conflict increased. Due to the war between Russia and Ukraine and the strong energy demand, The FTSE 100 fell sharply after rising, the Shanghai Composite index continued to fall, and The MOEX fluctuated greatly with the changes in the Russian-Ukrainian situation. With the disparity between supply and demand worsening, international oil prices have increased wildly, and the international market as a whole is in a state of great uncertainty.

Commodities

While energy prices have caught the attention of the market since Russia's military campaign in Ukraine, there have been some other worrisome things happening across the commodity sector: the price of corn, soybeans and wheat have all risen sharply. At the same time, gold prices also rose due to rising safe-haven demand. The trend of natural gas and crude oil is closely related to the situation in Russia and Ukraine. The shutdown of the "Nord Stream-2" project led to another surge in European natural gas, which rose by more than 10%. Near the end of the session, Daleep Singh, Biden's deputy national security adviser, said at the White House that the United States is considering the possibility of using the strategic oil reserve, which has caused some tension in the crude oil supply chain. As the situation in Russia and Ukraine may have a greater impact on European countries, Brent crude oil has received stronger support, and its recent rise has been stronger than that of US oil. On Wednesday, Brent's premium to WTI rose to its widest since the beginning of the outbreak, with the spread widening to nearly $5 a barrel. In addition, Russia and Ukraine are also important suppliers of wheat, corn and other crops, with Ukraine being known as the "granary of Europe". Markets fear that world food security may be at risk if the conflict escalates. In addition to wheat, Russia and Ukraine are also major barley exporters, Ukraine is one of the top five corn exporters in the world, and Russia also exports certain other agricultural products such as grapeseed oil. In this era of globalization, changes in regional supply and demand will soon be transmitted to the world. The United States, which is embroiled in the conflict, is a major exporter of agricultural products, but may also need to bear the pressure of higher prices.

Winning Trades

In this section, we will look at financial instruments that have gained more than 10% year to date.

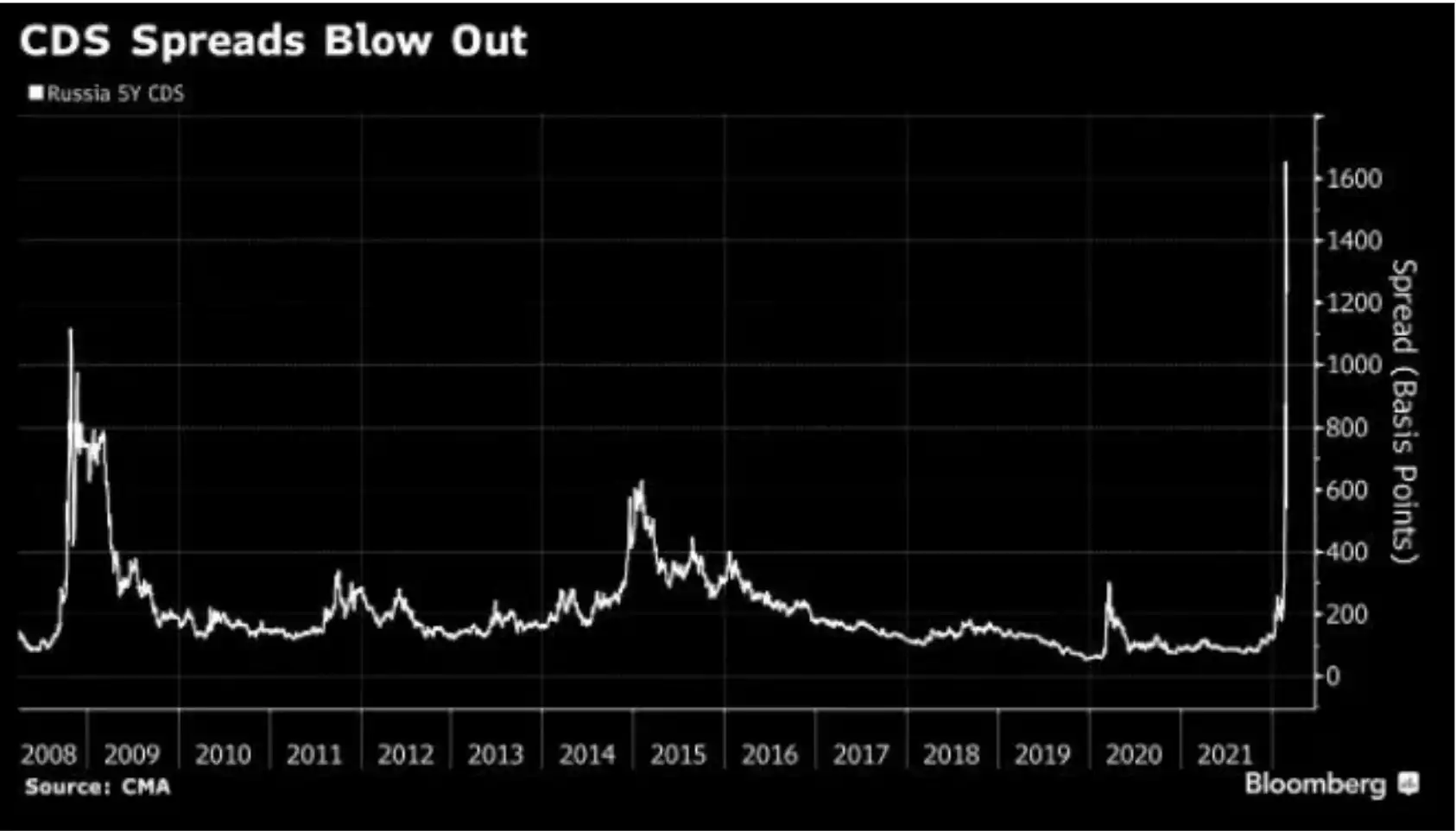

Russian Credit Default Swap

As mentioned above, sanctions from the international community against Russia have substantially increased the possibility of defaults on Russian sovereign debts. As a result, the Russian CDS, an instrument that essentially insures against default, has surged significantly.

Source: Bloomberg

Gold: The chart below shows the spot price of Gold. Gold has traditionally been a hedge against economic and geopolitical uncertainties. It has been going up especially after the commencement of the Russo-Ukrainian crisis.

Source: Bloomberg

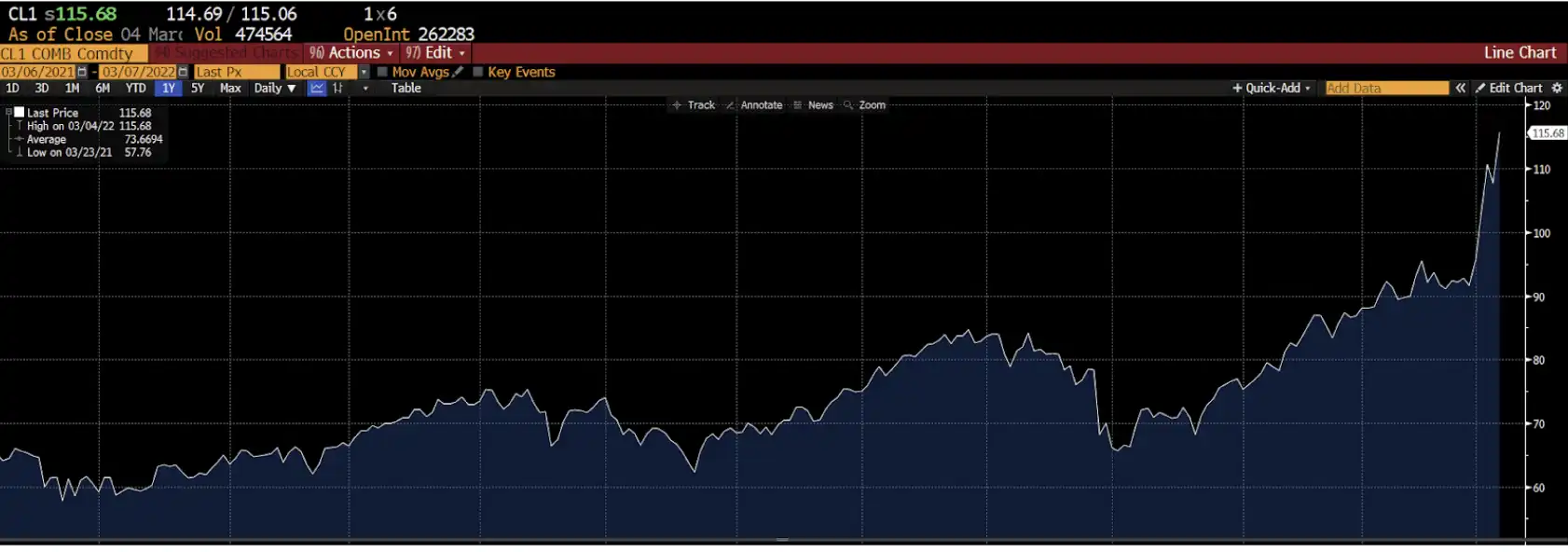

Oil: Supply-side issues have occurred since Russian troops entered Ukraine. As the biggest oil & gas supplier of Europe, Russia wields great influence on the oil markets. A bleaker outlook for Russia, worries over future oil & gas supplies to Europe, and geopolitical uncertainty all are driving up oil prices. April 2022 future contract for West Texas Intermediate crude oil has hit $115/Barrel, which is extremely high for oil prices.

Source: Bloomberg

Occidental: Occidental Petroleum Corporation (Ticker: OXY) has been one of the few stocks that actually generated high returns (over 80%) against a backdrop of broader market decline. It is mainly because of rising oil prices and the establishment of a $5 billion position in the company’s stocks by Berkshire Hathaway.

Source: Bloomberg

Losing Trades

In this section, we will look at financial instruments that have lost more than 10% year to date. Short positions on those trades would turn them into winning trades.

Russian Assets: Ruble & Stocks

Source: Bloomberg

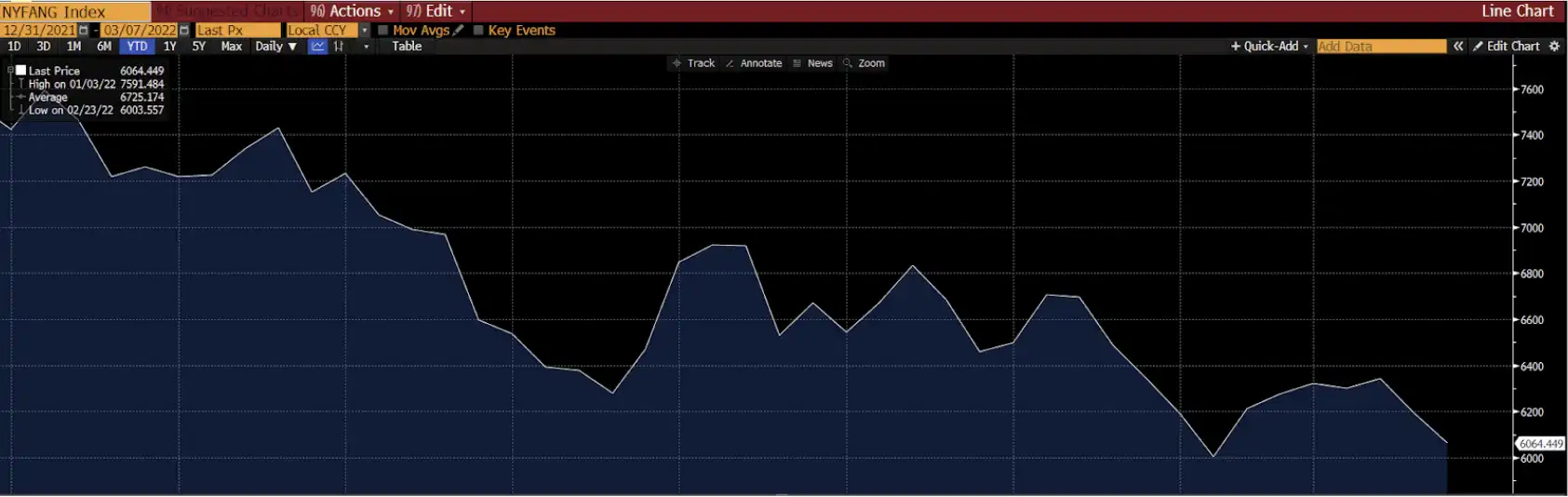

Tech Stocks: FANG + Index (Facebook, Apple, Amazon, Netflix, Google, Alibaba, Baidu, NVIDIA, Tesla, and Twitter)

Tech Stocks are down due to broader market decline, economic, as well as geopolitical uncertainties. They are more volatile than the broader markets and usually suffer more in a “down” environment. The FANG + index is down more than 20% year to date.

Source: Bloomberg

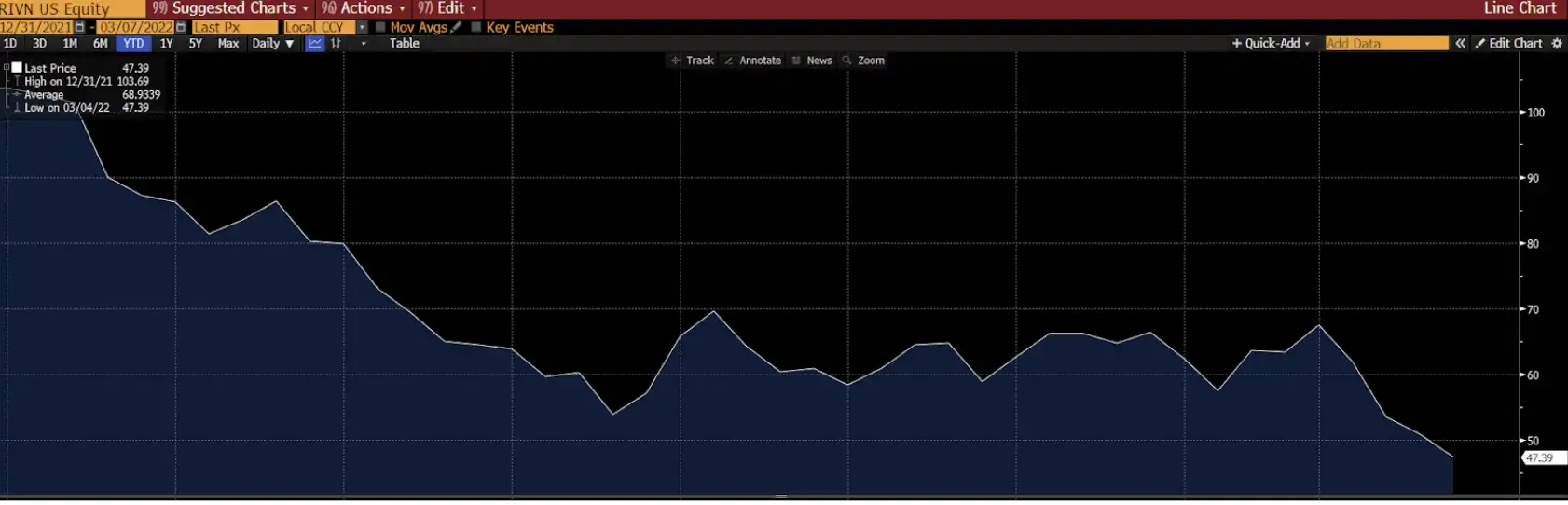

Rivian: Rivian’s IPO last year is considered as extremely overpriced and now it is suffering in a downturn environment that is not so friendly towards Tech and EV (Electric Vehicle) stocks with sky-high valuations. It is down more than 50% year to date.

Source: Bloomberg