China Evergrande – Too Big to Fail?

On Monday, September 13, 2021, a group of exasperated investors and homebuyers besieged Evergrande’s Headquarter in Shenzhen in an attempt to demand their money back. China Evergrande’s potential default might have serious implications on the Chinese economy and financial markets.

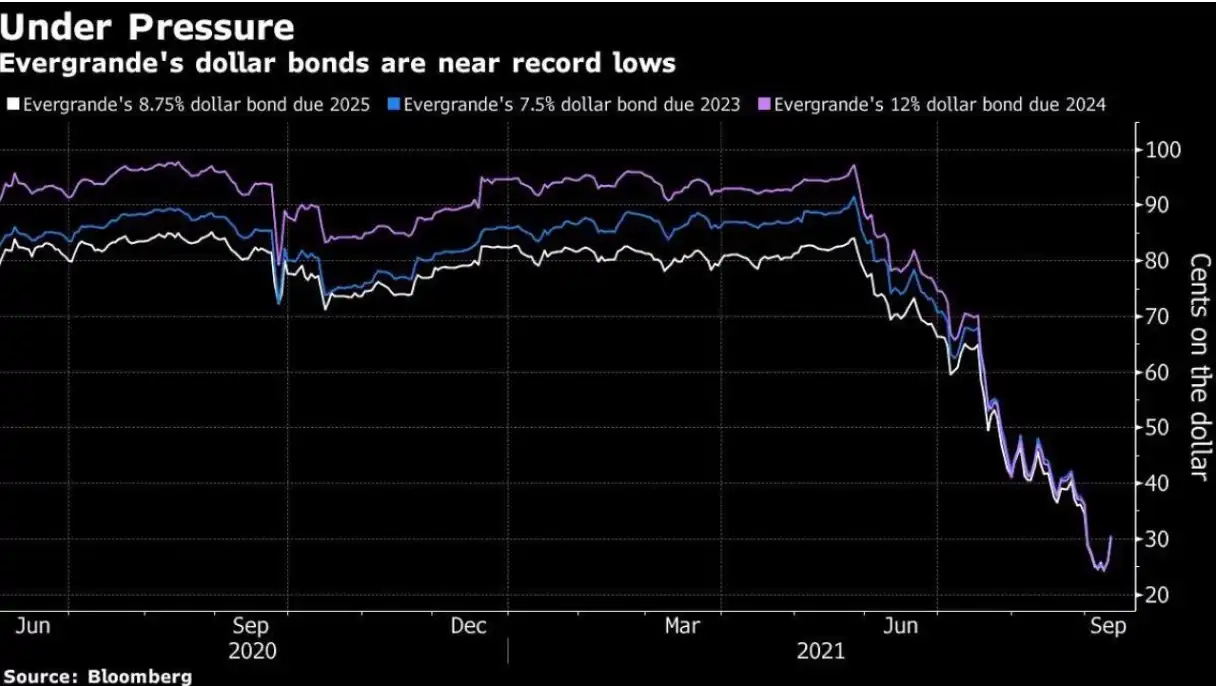

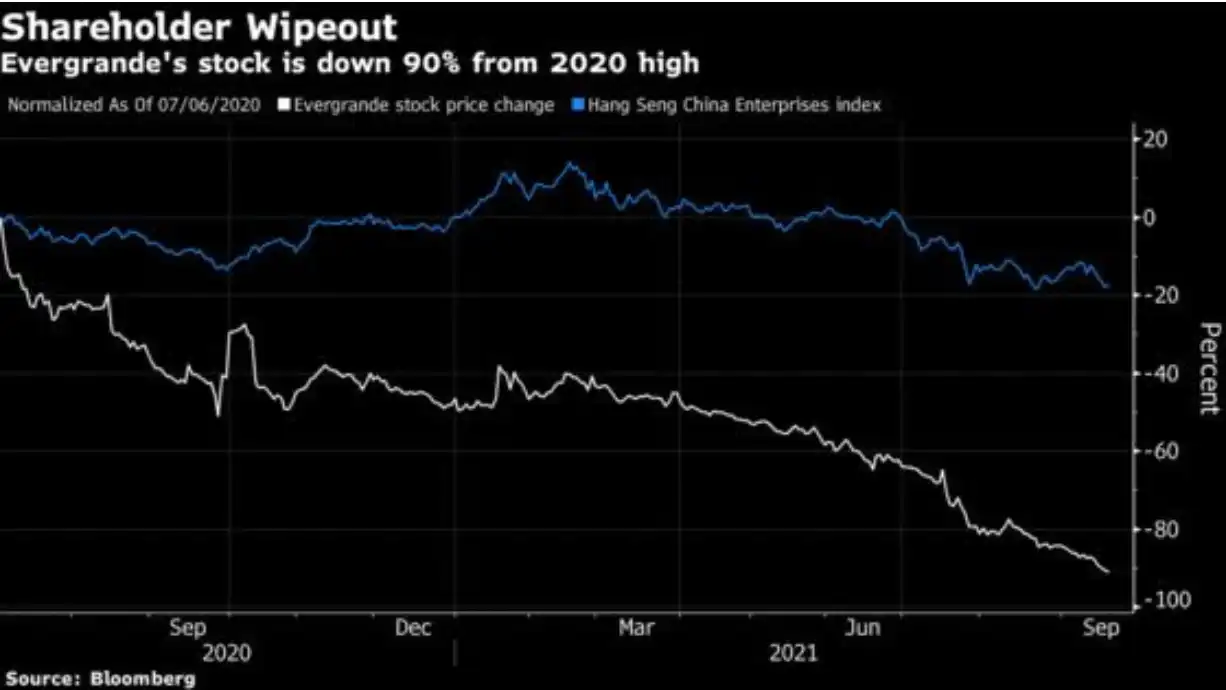

On Monday, September 13, 2021, a group of exasperated investors and homebuyers besieged Evergrande’s Headquarter in Shenzhen in an attempt to demand their money back. The dispute heated up as more than 50 security personnel formed a human wall in front of the main entrance, preventing unexpected trespassing to the towering skyscraper. Meanwhile, a silent battle has been taking place in the financial markets. Evergrande’s stock plunged more than 40% in the month of September and its USD bonds traded below 30 cents on the dollar, which is deemed very distressed. Believe it or not, the second-largest property developer in China is in some serious debt trouble and the ripple effect could be felt throughout the entire Chinese financial market and economy if the company goes under. Thirteen years after the US addressed the too-big-to-fail dilemma, originating from the bubbling housing market, China is now behind the too-big-to-fail steering wheel in a similar manner to potential defaults of both Huarong and Evergrande. We will focus on Evergrande in this article.

Founded by Hui Ka Yan in 1996, China Evergrande (恒大) was the former second-largest real estate developer based in the southern city of Shenzhen in Guangzhou Province. With roughly 1,300 real estate projects in 280 Chinese cities and 200,000 employees, the company builds and sells apartments to property buyers in the middle to upper income range. Additionally, Evergrande dabbles in other industries, including media, electric vehicles, and food production; it even owns a football club, Guangzhou Evergrande FC, which is unfortunately a money-losing endeavor.

As Evergrande’s debt woes have gradually worsened over the past few months, it is now standing on the brink of bankruptcy. During China’s real estate boom, the company racked up its leverage to take advantage of the flourishing property market. But being highly levered comes with downsides. With the pandemic slowing down the economy and Chinese government containing the potential overheating of the property market, the multifaceted real estate developer is now drowning in a huge amount of liabilities totaling roughly $305 billion with serious liquidity concerns (no pun intended). Despite debt financing, Evergrande also relies on presales to finance its operations. The company would obtain down payments from its customers on unbuilt properties and use the proceeds to complete unfinished projects. This also further increases Evergrande’s liability as pre-sales are recorded as unearned revenue, which is a liability item on the balance sheet.

The scope of Evergrande’s situation means much more than the failure of a single company. Investors, homebuyers, banks, and its employees are all taking a huge blow. There are serious societal, economic, and financial implications stemming from this corporate fiasco. As previously stated, Evergrande presold unbuilt properties across China to obtain cash needed for its operations. Since the company is currently unable to continue its work-in-progress apartment buildings, roughly 1.2 million home buyers could end up homeless and the company’s suppliers are hurt by not getting paid, which could lead to the undermining of social stability in China due to the company’s pervasive presence in Chinese society. Moreover, the potential contagion of Evergrande going under could pose serious systemic risk in Chinese financial markets and economy as Evergrande’s debt position is about 2% of Chinese GDP ($14 trillion). Since the property sector, one of the main drivers of China’s economic growth, accounts for almost 30% of Chinese economic output and more than 75% of household wealth in China is concentrated in real estate, a blow to the national property value resulting from the potential crash of Evergrande would be detrimental to the Chinese economy. Potential contagion could also negatively impact China's bank-dominated financial system as banking failure and liquidity squeeze might occur due to a series of potential defaults of Evergrande and its suppliers.

Too big to fail? Yes and no. The damage to the economy from an Evergrande default would be substantial but the financial and economic scopes of the situation should still be way limited in comparison to what happened in the US in 2008. Unlike the 2008 US housing market, there aren’t many complicated property-related financial products in the markets that create artificial value and wrap up the interests of almost every participant in the financial markets. Moreover, Beijing has an extremely strong control over the economy and markets, which could prevent things from going south. As of last Friday, the PBOC (People’s Bank of China, Chinese central bank) injected $14 billion into the financial system in order to strengthen the credit market and banking sector in response to Evergrande's debt crash. The company has also been searching for solutions to its debt problem such as potential restructuring and even a potential bailout from the government. As Evergrande’s debt problem has recently become an ongoing event in the markets, its further development will be able to give us a closer look into how China addresses too-big-to-fail situations. Is Evergrande going to resolve this on its own or are there any government actions to be taken? We will be providing brief coverage as the result emerges in the foreseeable future.

Glossary:

Leverage n./lever v. : The usage of debt financing as the source of capital

Liquidity: The availability of liquid assets such as cash and marketable securities to a market or company

Liquidity Squeeze: A liquidity squeeze occurs when a financial event sparks concerns among financial institutions (such as banks) regarding the short-term availability of money

Contagion: The spread of market disturbances – mostly on the downside – from one market to another

Default: Failure to fulfill a loan obligation; inability to repay loans