An Investigation of NYU Shanghai's Finances

After NYU Shanghai’s financial records were audited for the year ending December 31, 2016, the report (财务报表计审计报告 or Financial Audit Report) was made available to the public. The main finding is that there was nothing dodgy in the audit report, even though NYUSH reported a loss. But, the main lesson from reading through NYUSH’s financial disclosure is long term viability.

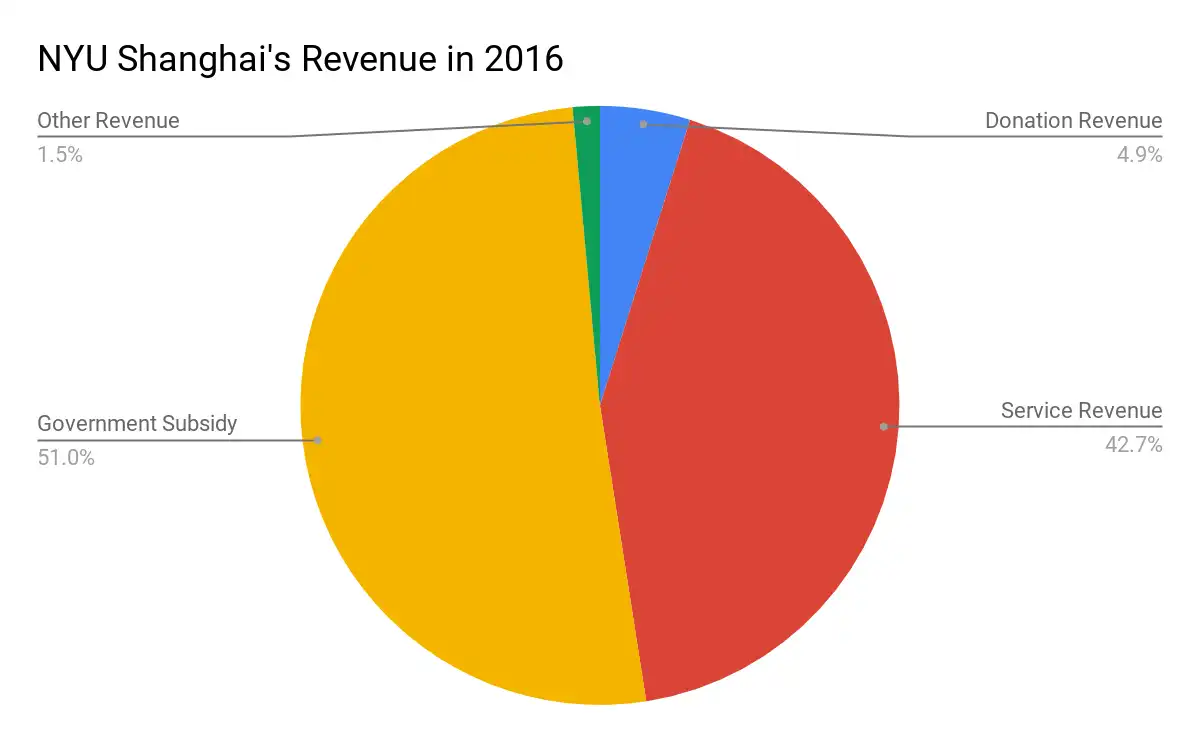

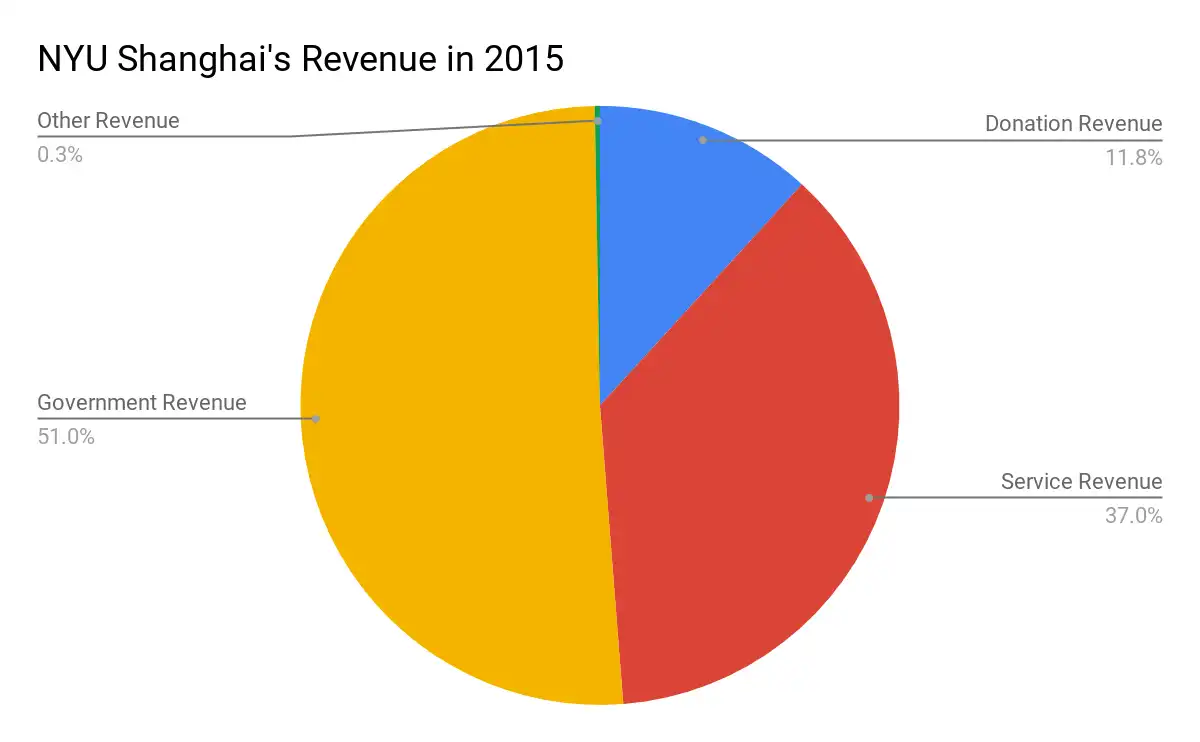

After NYU Shanghai’s financial records were audited for the year ending December 31, 2016, the report (财务报表计审计报告 or Financial Audit Report) was made available to the public. This report details the school’s finances for 2016 and the previous year, 2015, including information on revenue, government subsidies, donations, expenses, assets, and liabilities. This form was accessed, translated (from Chinese into English), and analysed by On Century Avenue. Here is what we found. The main finding was that there was nothing dodgy in the audit report, even though NYUSH reported a loss. For 2016, total revenue was 508,971,787.29 RMB ($79,939,007.12 USD) and total expenses were 569,272,671.11 RMB ($89,390,041.18 USD), making a loss of 60,300,883.8 RMB ($9,451034.06 USD). A similar loss was reported for 2015. However, this loss makes sense in economic terms, as NYUSH was (and is) new and to achieve financial growth, we must first burn cash. In the Fall of 2016, we had just reached full operation of four classes and as the university grows, the revenue should increase. In comparison to NYU New York and NYU Abu Dhabi, revenue for 2015 was $3.3 billion USD and $178.8 million USD respectively. The main lesson from reading through NYUSH’s financial disclosure is long term viability. To exist as a university we must guarantee a revenue stream. The audit report splits this revenue into donation revenue, service revenue (i.e. tuition), government subsidy revenue, and other revenue.

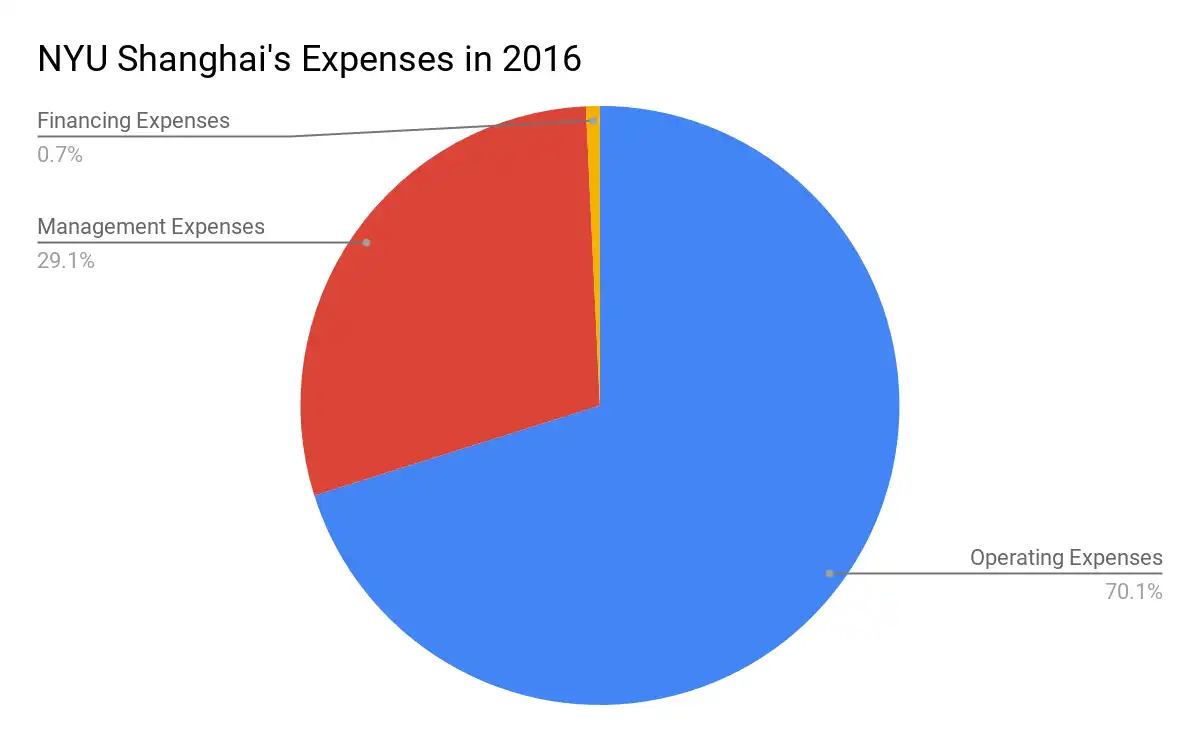

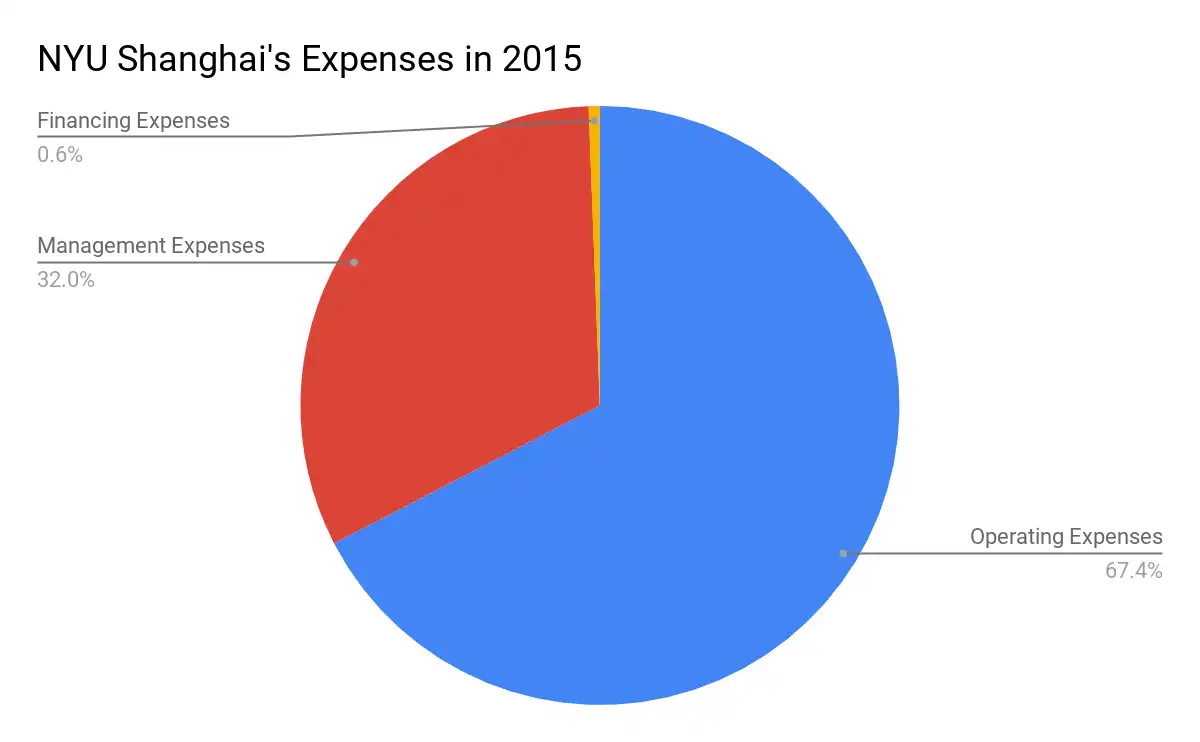

As the charts suggest, NYUSH was heavily reliant on government revenue, which was not-so-suspiciously exactly 51% of our revenue in both 2015 and 2016. This is keeping in mind that funding from the Chinese government differs from year to year and is based upon their five-year plans. “We are the recipient of generous support,” said Vice Chancellor Jeffrey Lehman. This support is also not simply economic, it is also social. To exist in China, Chinese government support is essential. However, NYUSH is “not a joint business, it is a joint venture,” said Lehman. Therefore, there is no ‘owner’ per se.NYUSH exists to “try to do good in the world,” said Lehman. Rather than just trying to make money, NYUSH exists for three purposes doing good through three things: teaching (to educate), research (to increase human understanding), and public service (to assist communities to thrive).Ultimately, it is important to remember NYUSH has a double identity. “NYU Shanghai is a Chinese university,” highlighted Chancellor Yu Lizhong. Thus, NYUSH has to try and meet requests both from the Chinese government and NYU policy. This includes requests on how to use money, meeting regulations, and keeping up a certain reputation. It is a “balance,” said Yu, but he believes “NYU Shanghai is quite successful” and “no financial challenge.” And fortunately for those about to graduate, post-graduate success is a tangible measure for how NYUSH is doing.But for context, NYUSH is not nearly as reliant on government subsidies as NYUAD. The Gazellereported that over 99% of NYUAD’s revenue came from UAE government grants from its inception to 2015 (when their analysis ended). In 2015, $148,983,283 USD was given to NYUAD by the UAE government, compared to $34,687,805 USD being given to NYUSH by the Chinese government. Although the amounts are barely comparable as raw figures because of differences in the two schools and the difference in the percentage of revenue provided by the governments can be explained by the fundamental formation of the two universities. The idea of NYUSH is to “improve education,” explained Yu, whilst the idea of NYUAD is to “develop education.” The investments of the two governments are different, and the Chinese government has a few eggs in a few baskets (even though NYUSH is a pretty large, well-funded egg). The UAE government has less eggs in their basket, so they are putting more resources into the NYUAD egg. But, to play devil’s advocate, if NYU Shanghai’s government subsidies decrease, would scholarships decrease and tuition skyrocket? Contributions only make up around 20% of NYU New York’s annual revenue, whilst tuition makes up almost 76% (in 2015, although this does vary from school to school). If we adopted a model more like NYUNY, would Chinese students have to pay more and would would happen to the diversity of the student body?“Almost no great university is able to cover its costs by simply tuition,” said Lehman. The “big issue for higher education right now is that we are producing something high quality but in a way that is very expensive,” he continued. NYU Shanghai is pretty much committed to our cost structure because we are New York University, which means we are aiming to provide the highest quality (world-class) education we can. But, we are also committed to financial aid in a different way. Scholarships are necessary to admit “good students,” said Yu, citing a general Chinese policy that “you cannot let any students who [are] qualified for your university not be admitted.” “We always need to think of good students who cannot afford to go [to NYUSH],” said Yu. Lehman shared this approach, noting a responsibility to keeping socioeconomic diversity, as well as an ethnic diversity.Of course there is a culture of donations at American universities. The 2013 Fund was established to promote this culture at NYU Shanghai and encourage students to give back, and the Shanghai Education Development Fund was established in 2014 as a body to conduct fundraising efforts.NYUSH’s actual budget is headed up by Vice Chancellor Lehman and is made two years in advance. It is an “elaborate process,” said Lehman, but resources are “not mysterious.” Each winter, the heads of each department go to the finance office and present their ‘dream’ for the following academic year. Using this, and other constraints, money is allocated. Naturally, it is unusual for everybody to get exactly what they want. But that’s just life. In terms of expenses the audit report categorised them into operating expenses (i.e. the expenses for doing business, salaries, pens and pencils), management expenses (i.e. salaries for management, deals and contracts), financing expenses (i.e. expenses of getting capital, interest rates, transaction fees), and other expenses.

Expectedly, operating expenses are the biggest expense possibly because faculty are a huge expense. This includes salaries, benefits, health insurance, and pensions, not to mention other expenses such as compensation, travel, and equipment. According to Lehman this should be about one third of a universities budget and we are “about right on that here.” The audit report quoted NYUSH’s start up capital as 41,000,000 RMB “all funded by the founder East China Normal University.” It was decided from the beginning that funds would go through ECNU, although it was understood that NYUSH would be self-financing after start-up costs. In addition, NYUNY loaned money to NYUSH early on, which we have been paying back. According to a presentation titled “NYU’s GNU Strategy: Financial Overview,” NYUAD and NYUSH also reimburse NYUNY for “faculty and administrative expenses and management fees of approximately $30 million USD per year.”In terms of assets, NYUSH’s total net assets were 87,972,627.98 RMB ($13,817,403.22 USD) in 2015 and 27,671,744.16 RMB ($4,346,256.96 USD) in 2016. For both years, assets were more than liabilities - which means we have enough resources to fulfill our financial obligations. Plus, NYUSH did not (and does not) own a campus; the Lujiazui Group allows us to use the Academic Building without paying rent. However, dorms have to be rented, hence a housing cost for students. Interestingly, when NYUAD moved campus in 2014 from Downtown to Saadiyat their net assets fell dramatically into negative $9.3 million USD. So will NYUSH fall? Well, according to this financial report, we aren’t about to approach financial ruin any time soon. These finances perhaps don’t mean much to students. Although, bankruptcy would mean our degree decreases in value. But for the faculty and for the sake of pride, the long term prospects of the school look and sound good. For Yu, “more money” is “more pressure.” For Lehman, NYUSH might just exist for “900 years.”A caveat to these analyses is that only one form was available to analyse, featuring just two years of data (2015 and 2016). These data might have been distorted by new students (the fall of 2016 was the first semester NYUSH had the full amount of students) and set up costs. Additionally, NYUSH’s budget is made for the academic year (split into three pieces - fall, spring, and summer), but the the audit is a calendar year document. If you wish to delve into accounting (inadvisable) and make some speculations of your own, the audit form can be found here (be warned it is in Chinese). And, if you’re still feeling financial NYU’s financial disclosures (990 forms) can be found here and NYUAD’s here. (The process of accessing NYUAD’s financial records is a little different because NYUAD is linked with NYU. NYUSH is a distinct legal person, created under the laws of China, whilst NYUAD is listed as a corporation of NYU and so has to publicly disclose financials records as a not-for-profit corporation in the United States under a 501(c)(3) nonprofit tax code designation that excuses most universities from taxation. I know, rather boring.)* The recording currency for NYUSH was RMB and for USD for NYU and NYUAD. Exchange rates were accurate at time of publishing.** This article would not have been possible without the translation skills and efforts of Editor-in-Chief Allison Chesky, and consultations with the Finance Department and Accounting Professors. For this, On Century Avenue will forever be in debt. This article was written by Stephanie Bailey. Please send an email to managing@oncenturyavenue.com to get in touch. Photo Credit: Zhang Zhan